By Cristina Commendatore, FleetOwner

What happens to over-the-road truck drivers as we know them when an SAE Level 4 automated truck is ready for the long haul? It’s a common question that comes up in industry conversations, but autonomous truck technology developers are intent on making one message crystal clear: Those interested in becoming truck drivers today can still retire as truck drivers in the next several decades.

“If a new driver wants to enter the field today, we can guarantee that he or she will retire a driver in 40 or 50 years,” Vivian Sun, VP of business development for TuSimple, pointed out during the Women in Trucking Association’s recent Accelerate! virtual event.

TuSimple sees trucking’s workforce issue as threefold, Sun noted. For starters, autonomous systems could help fill current driver gaps in the linehaul space. Autonomous vehicle (AV) technology will be rolled out in phases as operational kinks continue to be worked out. Finally, there always will be a need for drivers, though that role may look different years down the road, Sun said.

See also: Trucking’s safer, self-driving future is around the corner and TuSimple, UPS top 160,000 autonomous miles together, expand to East Coast

“In every single one of our vehicles, we have a safety driver in place,” Brenda Mejia, operations manager at Gatik, explained during WIT’s virtual conference. “These are individuals that we actively recruit from the trucking industry. They have such a wealth of knowledge that they also help us understand the truck and its maintenance needs to operate.”

From Gatik’s point of view, AV technology also will create new jobs within trucking’s ranks—in areas such remote driving assistance, new fleet maintenance practices, and technician requirements, and for operators needed to load and unload freight.

Discussions of when self-driving trucks will become a reality have been nearly impossible to ignore due to publicized developments and real-world testing coming from the autonomous vehicle (AV) space these days. Providers such as Aurora, Embark, Gatik, Kodiak, Locomation, Plus, Waymo, Torc Robotics, and TuSimple have elevated their production developments and partnerships to meet rising demand and expectations from end consumers, who crave more immediate deliveries and a 24/7 supply chain. Ecommerce, which was already on the rise, surged during initial pandemic lockdowns, causing grocery and other retail and delivery services to move their business operations that much closer to customers. The ecommerce economy went from annual 3% to 5% growth to a 20% increase in 2020.

AV developers have taken note and partnered with truck OEMs, powertrain manufacturers, and commercial fleets to advance and test the technology. During WIT’s event, Joanna Buttler, director of Daimler Trucks North America’s Autonomous Vehicle Program, noted that DTNA has partnered with AV developers Waymo and Torc Robotics to further improve commercial vehicle safety and enhance freight transportation.

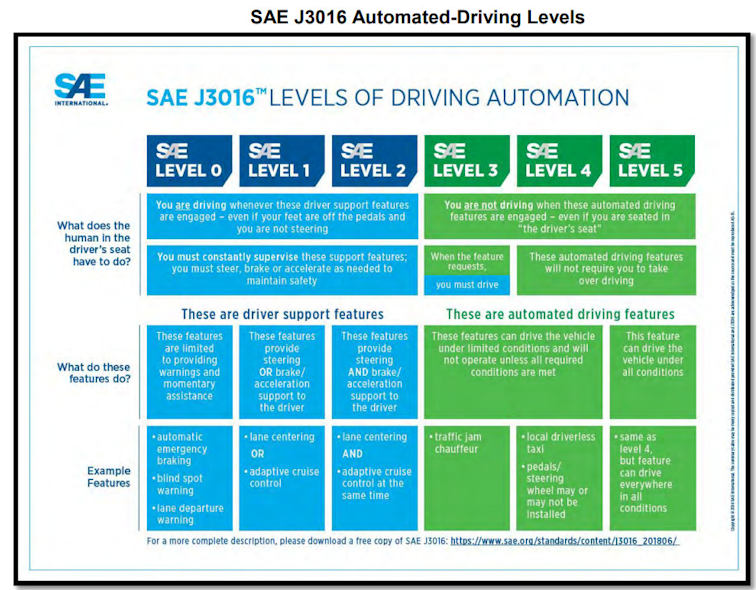

Right now, Buttler said fleets are adopting Level 2 driver-assistance systems more and more as conscious investments in safety and driver comfort. Level 4 autonomy, she noted, takes today’s Level 2 technologies to the next level.

“Keeping the goods flowing 24/7, and doing that safety and more efficiently, is a major driver,” Buttler said. “That’s where Level 4 brings really great advantages. It’s a complementary mode of transportation, so it will supplement the driver shortage need that we see and keep goods moving 24/7. When drivers have to take a break and need to rest, the technology can keep on going, so to speak.”

Through DTNA’s partnership with Waymo, the Freightliner Cascadia will be outfitted with the Waymo Driver and will be available to fleet customers in the coming years, noted Frances Guo, product manager for trucking at Waymo.

See also: Torc Robotics quietly developing the fleet product of the future

And when it comes to fleet maintenance and new jobs in terms of maintaining autonomous vehicles, Guo said understanding new requirements for technicians also has been an ongoing discussion.

“There are a whole host of [jobs] involved that aren’t going to go away overnight,” Guo explained. “Right now, Waymo is focused on the driving task and everything else to support the driving. We need people on board to load and unload the cargo, inspect the trucks and trailers, refuel, record deliveries, dispatch, and technicians to maintain the vehicles. There are a whole bunch of opportunities that will open up as we develop this technology.”

Overall, DTNA’s Buttler said the end goal will be to demystify the notion that autonomous truck technology will endanger industry jobs.

Expect a change in operations

From an operational perspective, although AV technology isn’t expected to endanger various jobs across the trucking space, TuSimple’s Sun does envision significant changes for fleet operators.

Terminals, Sun said, will need to be queued up and integrated as AV-certified. She added that certain infrastructure to accommodate data uploads also will need to be installed at fleet, shipper, and end-customer locations.

Another change, Sun anticipates, is how fleets will utilize their assets.

“With autonomous vehicles, one of the benefits is assets can run day and night, rain or shine,” Sun said. “It’s a competitive advantage for a fleet that can manage their network more quickly, address safety concerns, move assets more quickly, and turn them around for improved uptime.”

DTNA’s Buttler emphasized the importance of a smooth business transition by leveraging partnerships across the entire value chain.

“We are looking to release this technology first in a hub-to-hub use case, so for some fleets that means a change of their operational model if the technology cannot reach the final depot,” she explained.

When it comes down to who will operate those hubs, Buttler said it could be an upscaled version of technicians who are tasked with monitoring the health of the vehicle, and/or AV operators and dispatchers to oversee autonomous mission controls.

Regulatory patchwork for AVs

The road to autonomous trucks in the U.S., though paved with general federal support, remains a patchwork of regulatory environments among the states. And certain parts of the country, like Arizona, Texas, and New Mexico, have been welcome to autonomous truck testing.

Right now, two federal agencies in the U.S.—the National Highway Traffic Safety Administration and Federal Motor Carrier Safety Administration—are supportive of autonomous truck development and are undergoing rulemaking processes. But because AV systems are not looking to dramatically change the commercial vehicle itself, NHTSA’s rulemaking at this time is about accommodating drivers, James “Wiley” Deck, VP of government affairs at Plus, told FleetOwner during American Trucking Associations’ (ATA) 2021 Management Conference and Exhibition (MCE) in Nashville. Deck previously served as the FMCSA’s deputy administrator under President Trump.

As for FMCSA, according to the U.S. Department of Transportation’s AV 3.0 issued in 2018, current guidance and discussion about the future of AVs would not require a human in the cab. Though nothing is set yet.

“Now, nobody is talking about doing that right now,” Deck said. “The technology is still developing and maturing, but it’s moving rather quickly in that direction.”

“With us and the others in the industry, safety is paramount,” he added. “We are not going to put a product out there on the road that we think might endanger other road users.”

Because the feds haven’t set a national standard, states are coming up with limited, varying standards. For the most part, Deck told FleetOwner, states allow testing and deployment of AVs—with California being the outlier. California currently allows for the testing of passenger vehicles, but specifically prohibits the operation of large trucks or vehicles over 10,000 lb.

“We believe the technology will be there for 2024, but there are things we don’t control,” Deck said, pointing to CVSA inspections and FMCSA regulations.

One of the challenges with the technology now, Deck added, is training it to operate on snow and ice.

As for the truck drivers who are concerned that these systems will put them out of work, Deck said the trucking industry as a whole is so large, mostly made up of fleets of 50 power units or fewer. Widespread adoption would depend on how quickly those operations would automate their fleets, he said.

“If you are interested in becoming a truck driver now, go ahead,” Deck advised. “You are going to be able to retire as a truck driver. The industry is so large that you have an estimated 80,000 driver shortage—and those are just the drivers we are short. How quickly can the OEMs start manufacturing automated trucks to fill the capacity we are short?”

“Then, you calculate in the fleet sizes and what they do with their existing trucks after five or six years,” Deck continued. “Those companies want to get a return on investment on the trucks they purchase and sell to a mom and pop or owner-operator, so existing trucks are going to stay in the industry for quite some time.”